أنشئ حسابًا أو سجّل الدخول للانضمام إلى مجتمعك المهني.

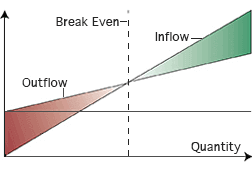

In the simple analysis, break even is the unit volume that balances total costs with total gains for a net cash flow of0. The break-even point (volume) is determined by just three variables: Fixed cost, variable cost per unit, and revenues per unit.

Break-Even Point Analysis

The cost of doing business in many situations includes fixed costs and variable costs. For activities such as budgeting, production planning, and profit forecasting, it is crucial to understand the relationships between fixed and variable costs on the one hand, and business volume, pricing, and net cash flow on the other. Break-even analysis is central to this understanding. Example calculations below show how break-even analysis is applied.

Fixed costs :- costs that remain constant, regardless of sales or manufacturing volume. For example, if floor space costs, general managers salaries, and janitorial services, do not change with business volume, they are fixed costs. In simple situations, total fixed cost remains constant, regardless of business volume

Variable costs :- vary in direct proportion to business volume (quantity sold, or quantity produced). The variable costs for selling goods, for instance, might include the direct cost the seller paid to acquire each unit sold. Here, the total variable cost can be as simple as the cost per unit multiplied by the number of units sold.

Semi-variable costs :- are constant across a range of business volume levels but change when business volume goes out of that range. The cost of hiring a call center operator, for instance, might qualify as a fixed cost when call volume is between0 and calls per day. A second operator might be needed if call volume is between and calls per day, and a third might be needed if daily call volume is-. Within each call volume range (e.g.,-), operator cost is a fixed cost. Across all ranges (0 - calls per day), operator cost is a semi-variable cost.

The break-even point is the specific business volume that answers questions like these:

In other words, how much business must we have in order to break-even? Break-even analysis attempts to answer by analyzing the relationships between fixed costs, variable costs, and incoming cash flow. In complex situations with semi variable costs or variable pricing, one or more additional factors must also be considered.

Break-even analysis is a mathematical model that relates cost and income with quantity of products produced. The break-even point indicates the number of units that must be made and sold before cost equals income. Or, the point when profit begins.

The Break-even point (B) is calculated by dividing fixed cost (FC) by unit selling price (P) minus unit variable costs (V).

The break-even point identifies the total amount of sales the business needs before profit can be earned. When analyzed closely, the break-even analysis also helps the business to identify excessive fixed costs. Since the break-even point is directly related to the fixed costs, reducing and controlling these costs aids the business in achieving a lower break-even point for quicker profitability.

I agree with the detailed explanation given by Mr. IMRAN ALI MOHAMMED

The cost of doing business in many situations includes fixed costs and variable costs. For activities such as budgeting, production planning, and profit forecasting, it is crucial to understand the relationships between fixed and variable costs on the one hand, and business volume, pricing, and net cash flow on the other. Break-even analysis is central to this understanding. Example calculations below show how break-even analysis is applied.

Fixed costsre costs that remain constant, regardless of sales or manufacturing volume. For example, if floor space costs, general managers salaries, and janitorial services, do not change with business volume, they are fixed costs. In simple situations, total fixed cost remains constant, regardless of business volume

Variable costs vary in direct proportion to business volume (quantity sold, or quantity produced). The variable costs for selling goods, for instance, might include the direct cost the seller paid to acquire each unit sold. Here, the total variable cost can be as simple as the cost per unit multiplied by the number of units sold.

Semi-variable costs are constant across a range of business volume levels but change when business volume goes out of that range. The cost of hiring a call center operator, for instance, might qualify as a fixed cost when call volume is between 0 and 100 calls per day. A second operator might be needed if call volume is between 101 and 200 calls per day, and a third might be needed if daily call volume is 201-300. Within each call volume range (e.g., 201-300), operator cost is a fixed cost. Across all ranges (0 - 300 calls per day), operator cost is a semi-variable cost.

The break-even point is the specific business volume that answers questions like these:

In other words, how much business must we have in order to break-even? Break-even analysis attempts to answer by analyzing the relationships between fixed costs, variable costs, and incoming cash flow. In complex situations with semi variable costs or variable pricing, one or more additional factors must also be considered.

Note that business analysts also refer to a similar but different concept, the break-even point in time, that is the payback period or time required for investment returns to cover investment costs (See the Encyclopedia entry on payback period for complete coverage).

Understanding both kinds of break-even points (time and business volume) is especially important when planning a new business. Business start ups typically lose money for a while before becoming profitable, but there is a limit to the time owners will tolerate net losses. Before starting, they have a keen interest in calculating the break-even business volume. A decision to go forward launching the business may depend on the owners assessment of the time, costs, and actions required to reach that volume. The new company will turn profitable only by exceeding break-even volume.

Break even point is the point of intersection of Total Cost ( Variable cost + Fixed Cost) and Revenue generated on graphical presentation. In nutshell, the point where Revenue generated is absorbing the total cost is called Break even point. In other words it is the no profit no loss scenario. The study of all this is called Break even analysis.

It helps the decision maker in setting prices , preparing for the bids , applying for credits from banks etc.

Thank you for invitation ,

In Commercial field Break-even is : To have no profit or loss at the end of especially a business activity .

But unfortunately I do not have enough information about analysis in manufacturing field.

Thank You Mr Fazlur Rahman for your invitation ... I will agree with the answers that really covered your question .. Nothing to add !