أنشئ حسابًا أو سجّل الدخول للانضمام إلى مجتمعك المهني.

A 'Smart' Question indeed! Thanks Mr. Ghazi.

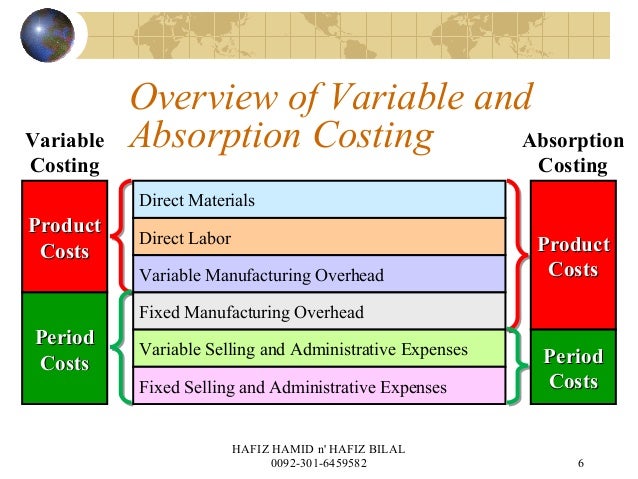

In the field of accounting, variable (direct) costing and absorption (full) costing are two different methods of applying production costs to products or services. The difference between the two methods is in the treatment of fixed manufacturing overhead costs.

Under the direct costing method, fixed manufacturing overhead costs are expensed during the period in which they are incurred.

Under the full costing method, fixed manufacturing overhead costs are expensed when the product is sold.

Variable and absorption are two different costing methods. Almost all successful companies in the world use both the methods. Variable costing and absorption costing cannot be substituted for one another because both the systems have their own benefits and limitations.

These costing approaches are known by various names. For example, variable costing is also known as direct costing or marginal costing and absorption costing is also known as full costing or traditional costing.

The information provided by variable costing method is mostly used by internal management for decision making purposes. Absorption costing provides information that is used by internal management as well as by external parties like creditors, government agencies and auditors etc.

Computation of unit product cost under two methods:Under absorption costing system, the product cost consists of all variable as well as all fixed manufacturing costs i.e., direct materials, direct labor and factory overhead (FOH). But when variable costing system is used, the fixed cost (both manufacturing and non-manufacturing) is treated as a period or capacity cost and is, therefore, not included in the product cost.

Following exhibition summarizes the difference between variable costing and absorption costing:

Variable versus absorption costing

For further clarification of the concept, consider the following examples:

Example 1A company manufactures and sells 5000 units of product X per year . Suppose one unit of product X requires the following costs:

Direct materials: $5 per unitDirect labor: $4 per unitVariable manufacturing overhead: $1 per unitFixed manufacturing overhead: $20,000 per year

The unit product cost of the company is computed as follows:

Absorption Costing Variable Costing $5 $5 $4 $4 $1 $1 $4* – ——- ——- $14 $10 ——- ——-* $20,000 / 5,000

Notice that the fixed manufacturing overhead cost has not been included in the unit cost under variable costing system but it has been included in the unit cost under absorption costing system. This is the primary difference between variable and absorption costing.

Example 2Sunshine company produces and sells only washing machines. The company uses variable costing for internal reporting and absorption costing for external reporting. The data for the year 2010 is given below:

Direct materials $150/unit Direct labor $45/unit variable manufacturing overhead $25/unit Fixed manufacturing overhead $160,000 per year Fixed marketing and administrative expenses $110,000 per year Variable marketing and administrative expenses $15/unit soldCompany produced and sold 8,000 machines during the year 2010.

Required: Compute unite product cost under variable costing and absorption costing.

*$160,000 / 8,000 Units = $20

Note: Marketing and administrative expenses are period costs and are not relevant in the computation of unit product cost.

Absorption Costing is required under US GAAP and IAS standards. It treats all manufacturing costs including raw material (variable), direct labor (treated as variable under full absorption), and manufacturing overhear (treated as variable, semi variable and fixed costs) included in inventory value and cost of goods sold based upon some method of attributing these costs into the inventory value. Some methods for putting overhead into inventory values is based on direct labor hours, labor dollars, units produced as examples.

Variable costing is not GAAP, but it treats costs as variable and fixed to analyze profitability and does not separate manufacturing and General and Admin costs as certain impacts to profitability such as sales commissions vary with sales volume. Also, certain costs such as Direct Labor may be considered fixed for operations where direct labor is fixed.

absorption cost = fixd cost + total variable cost may be use it for pricing when you work full capcity and conformity with gaap & ifrs we can use it in external reports

variable cost = it depend only in variable cost and ignore fixed cost it very usefull for performance evaluation and also we use it for pricing when you have excess capcity i cant use this reports for external purpose like tax

variable cost per unit is fixed

variable cost as total variable

fixed cost per unit is variable

total fixed cost is fixed, all this assumption in relevant range