Register now or log in to join your professional community.

(a) Net profit as a percentage of the average of the opening and closing borrowings.(b) Net profit as a percentage of the average of the opening and closing capital.(c) Net profit as a percentage of the average of the opening and closing total assets.(d) Net profit as a percentage of the average of the opening and closing fixed assets.

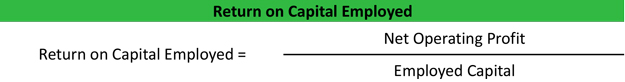

Return on capital employed formula is calculated by dividing net operating profit or EBIT by the employed capital.

If employed capital is not given in a problem or in the financial statement notes, you can calculate it by subtracting current liabilities from total assets. In this case the ROCE formula would look like this:

(b) Return on Capital employed is EBIT over Capital Invested (or) Total Assets - Current Liabilities