Register now or log in to join your professional community.

Can i change the depreciation rates entered in the system if these are later revised? and how?

enter all depreciation manuly

Depreciation in QuickBooks should be only be done in manually

Well, once you entered the rates of depreciation when recording your fixed assets, after that it calculate automatically on selected depreciation method. Now if you want to change the rates of depreciation you should manually replace the old rates of depreciation. But always remember that it not violate the rules of IAS8 change in accounting policies an accounting estimates.

When using QuickBooks for your accounting system, you don’t have to manually calculate depreciation expense amounts for your business. The Planning & Budgeting section of QuickBooks includes Decision Tools, and one of those tools helps you figure out your depreciation expense.

Depreciation doesn’t involve the use of cash. When talking about accounting, depreciation is purely a way to show how quickly you’re using up an asset.

With multiple methods available for depreciating your company’s assets, you’re probably wondering which method you should use. Your accountant can look at the way your business operates and determine which method makes the most sense for presenting your financial data.

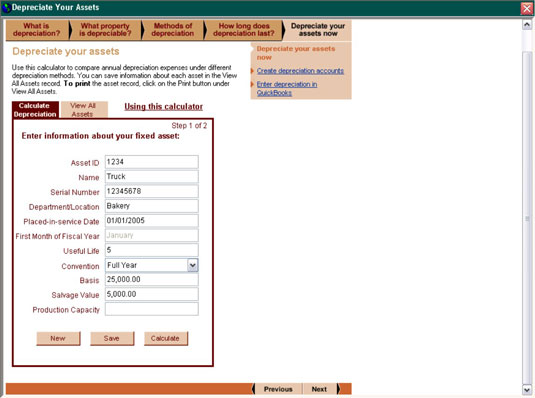

The first step in using QuickBooks for depreciation calculations is entering information about your fixed assets, as shown here:

You can enter information about your fixed assets in QuickBooks.

You can enter information about your fixed assets in QuickBooks.

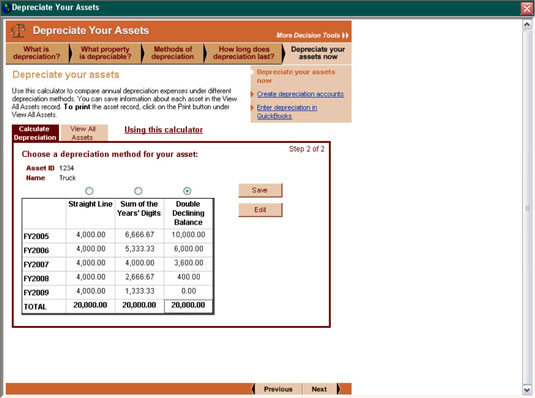

After you enter asset information, the system automatically calculates the depreciation expense using the Straight-Line method, the Sum-of-Years-Digits method, and the Double-Declining Balance method, as shown here:

QuickBooks calculates the depreciation expense using all three methods and lets you choose the one you want to use.

QuickBooks calculates the depreciation expense using all three methods and lets you choose the one you want to use.

You select the method you want to use and save the information about each asset, which you can then refer to at the end of each year when you need to record the depreciation expense for that year.

When you actually enter the data in your computerized accounting system, be sure to check with your accountant on how to enter that data based on how your system was initially set up. Depreciation expense, because it does not involve cash, is a bit more complicated to enter.