Register now or log in to join your professional community.

This involves charging a different price to different groups of people for the same good. For example: student discounts, off peak fares cheaper than peak fares.

1. First Degree Price Discrimination

This involves charging consumers the maximum price that they are willing to pay. There will be no consumer surplus.

2. Second Degree Price Discrimination

This involves charging different prices depending upon the quantity consumed.

E.g. after 10 minutes phone calls become cheaper.

3. Third Degree Price Discrimination

This involves charging different prices to different groups of people. E.g. students, OAPs and peak travellers e.t.c.

More on third degree price discrimination

The firm must operate in imperfect competition, it must be a price maker with a downwardly sloping demand curve.

The firm must be able to separate markets and prevent resale. E.g. stopping an adults using a child’s ticket.

Different consumer groups must have elasticities of demand. E.g. students with low income will be more price elastic.

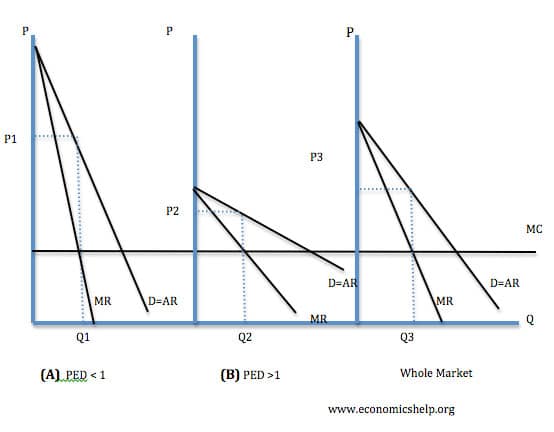

To maximise profits a firm sets output and price where MR=MC. If there are 2 sub markets with different elasticities of demand. The firm will increase profits by setting different prices depending upon the slope of the demand curve.

Profit is maximised where MR=MC. Because demand is more inelastic in market (A) it leads to a higher price being set. In market (B) demand is price elastic, so profit maximising price is lower.

Firms will be able to increase revenue. This will enable some firms to stay in business who otherwise would have made a loss. For example price discrimination is important for train companies who offer different prices for peak and off peak.

Increased revenues can be used for research and development which benefit consumers

Some consumers will benefit from lower fares. E.G. old people benefit from lower train companies, old people are more likely to be poor.

Some consumers will end up paying higher prices. These higher prices are likely to be allocatively inefficient because P > MC.

Decline in consumer surplus.

Those who pay higher prices may not be the poorest. E.g. adults could be unemployed, OAPs well off.

There may be administration costs in separating the markets.

Profits from price discrimination could be used to finance predatory pricing.

In markets where the marginal cost of an extra passenger is very low. E.G. a bus traveller the firm has an incentive to use price discrimination to sell all the tickets. This is why sometimes prices for airlines can be very low just before their date. Once the company is due to fly the MC of an extra passenger will be very low. Therefore this justifies selling the remaining tickets at a low price.

This involves charging a different price to different groups of people for the same good , consumers will benefit from lower fares - prices