Register now or log in to join your professional community.

Depreciation Is A Charge On Fixed Assets Except Free Hold Land Due To Usage and Also An Expense To income Statement.

Depreciation is the reduction in the value of a fixed asset over its useful life.

In business, depreciation refers to the wear and tear of the fixed assets used in operations, while in accounting, depreciation is the expense charge representing the loss in the value of an asset.When a company purchases a fixed asset, it capitalizes the full cost of the asset on its balance sheet Instead, the company records depreciation, or expenses a portion of the cost each year.

Depreciation - " Systematic, Rationality, Allocation of Assets Valve to Expenses"

In accounting, Depreciation is the term which reflects the amount deducted from a tangible asset due to salvage in value. An asset can either appreciate or depreciate depending on the type of assets. However, every asset with a useful life will always depreciate overtime, unless add-ons that enhance its value were in place. However, the add-ons will come at costs as well.

The most common depreciation methods include:

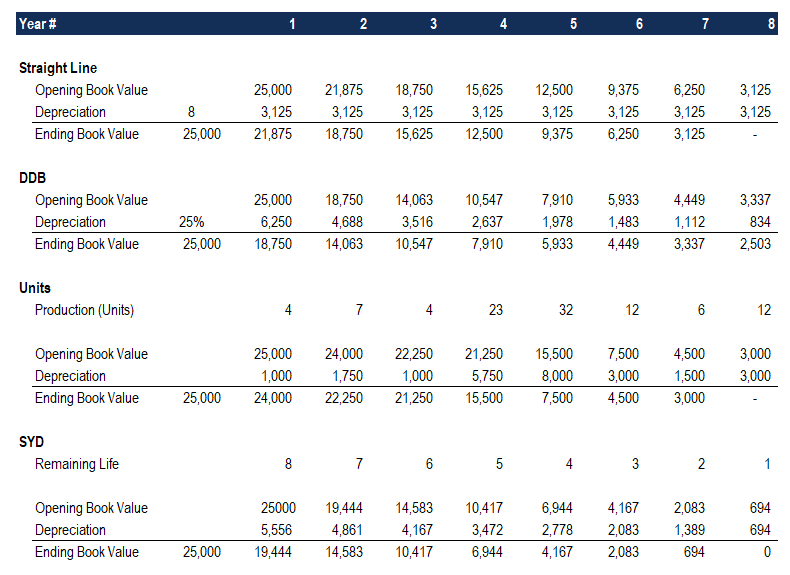

1- Straight-line.

2- Double declining balance.

3- Units of production.

4- Sum of years’ digits.

Every method has its unique way of measurement which can be useful for different situations and accounting methods.

Example:

Depreciation/Appreciation can affect both Net worth and Net profit of a company.

Such amount which is deducated from the value of any assest due to its salvage is known as Depreciation.

Depreciation is the reduction due to usage to the value of a fixed asset in proportion to it's useful life.

Depreciation is based on the concept of accruals. The accruals concept require to match the income and expense of the same period. when non current asset is purchased then there full cost in not deducted from that period income but the expense is deducted proportionally which is called depreciation expense. This is because the non current asset generates income for certain period and therefore its initial cost is proportionally deducted from the income generated.

Depreciation is dealt under IAS 16 property plant and equipements. depreciation is calculted in various methods such straight line ,reducing balance, which include use of information about nca such as its cost, expected life and residual value.

Depreciation is the reduction in the value of a fixed asset due to wear and tear over its lifespan.

In terms of Accounting. Depreciation is treated as a non cash expense. It will appear in the P&L account as an indirect expense & the same value should be deducted from the concerned Fixed asset in the balance sheet.

DEPRECIATION IS A METHOD OF REDUCING THE VALUE OF AN ASSET ACCORDING TO THE WEAR AND TEAR OR LIFE OF THE ASSETAS WE USE IT.

The systematic allocation of the cost of an asset from the balance sheet to Depreciation Expense on the income statement over the useful life of the asset.